Table of Contents

Every accountant knows the feeling that hits the moment an auditor calls: panic.

Spreadsheets open, paper files pile up, and someone in the office says,

“Where’s that invoice from last March?”

The stress isn’t about money; it’s about messy data.

As 2026 begins, financial transparency is no longer optional. Businesses are expected to maintain digital, accurate, and easily traceable records. That’s where Odoo 19 Accounting steps in as a modern, AI-powered system built to keep you audit-ready, compliant, and calm.

This isn’t just accounting software, it’s your digital armor against audit anxiety.

The Audit Panic Is Real

Let’s face it, audits are stressful because traditional accounting methods rely on too many moving parts:

- Scattered receipts and paper trails

- Manual journal entries

- Misplaced invoices or duplicate bills

- Long reconciliation processes

- Unclear approval trails

One small error can cause hours of backtracking or worse, trigger compliance issues.

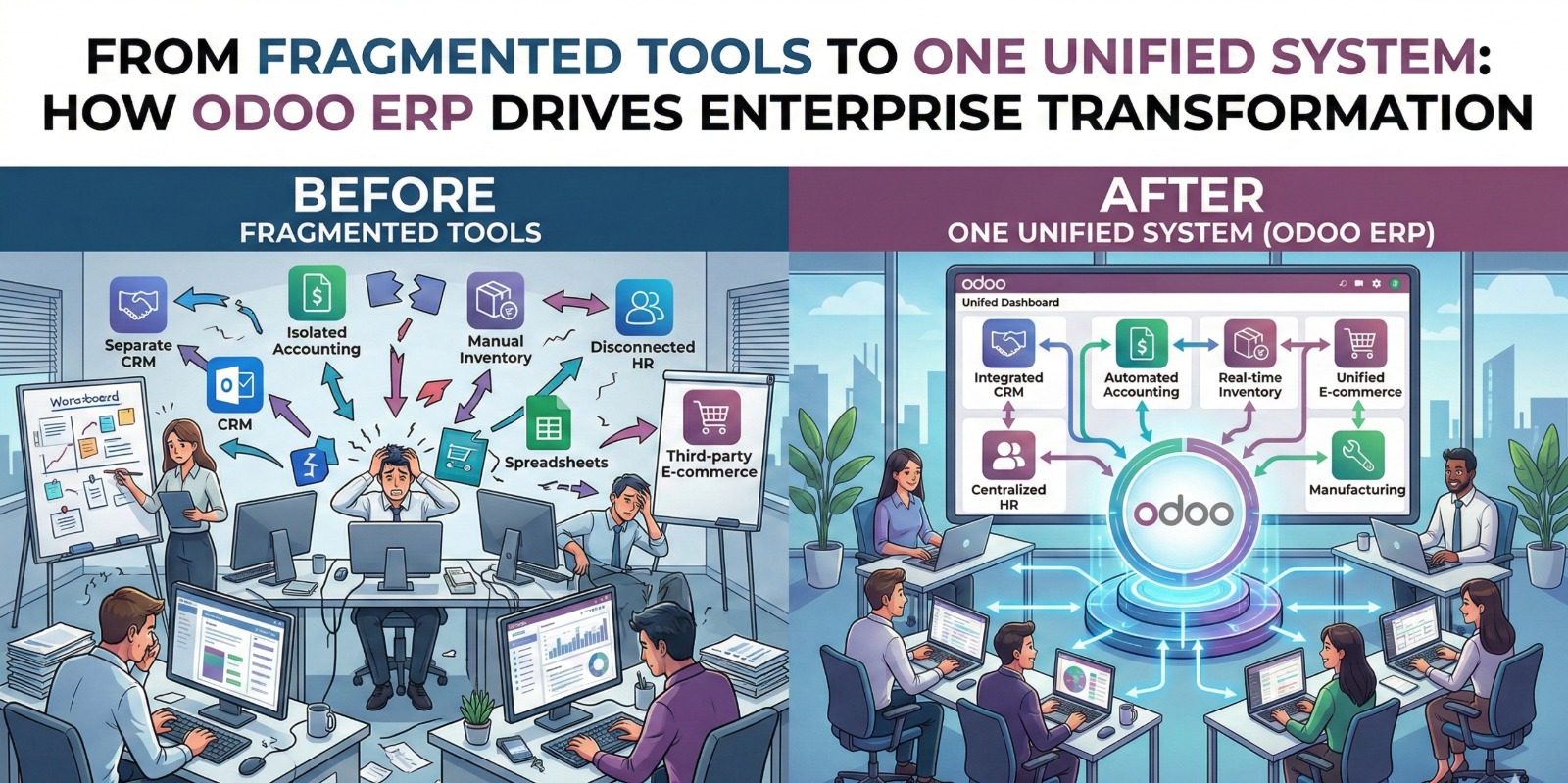

Businesses across all regions, from tech startups in Dubai to manufacturing units in Africa and service firms in the US, face the same problem: no unified system to track every transaction.

Enter Odoo Accounting: Smart, Secure, and Audit-Proof

Odoo 19 has completely reimagined accounting for modern businesses.

Its goal is simple to make audits transparent, effortless, and error-free.

Here’s how it turns chaos into control:

1. Digital Audit Trail — Every Action, Every Click

Odoo automatically records who did what, when, and why.

From invoice creation to final posting, every step leaves a digital footprint.

This means auditors can trace transactions easily without your team scrambling to find evidence.

“Every number tells a story and Odoo keeps that story organized.”

2. Centralized Paperless Records

Forget dusty files or lost receipts.

Odoo lets you upload and store PDFs, bills, receipts, and contracts directly in the system.

The built-in OCR (Optical Character Recognition) tool reads and fills in the details for you.

Need to find a payment from February? Just type a keyword it’s there in seconds.

3. Smart Reconciliation — No More Guesswork

The bank reconciliation interface has been revamped in Odoo 19 to make life simpler.

- It automatically matches invoices and payments.

- Flags unusual or duplicate entries.

- Allows manual corrections right from the PDF view.

Even if you handle multiple accounts across countries or currencies, Odoo recognizes and syncs everything, keeping your books spotless.

4. New Composite Reports for Year-End Clarity

The Annual Statements Composite Report combines your balance sheet, profit & loss, and trial balance all in one document.

You can print, export, or share it with auditors instantly.

No toggling between multiple files or tabs.

It’s a single source of truth for your financial health and your first line of defense during an audit.

5. Light Audit Trail: Transparency for All

Odoo now includes a non-restrictive audit trail by default, visible to all authorized users.

This gives managers and accountants instant visibility into what’s been posted, who approved it, and if any changes were made.

No hidden edits. No confusion.

Just a clear record of accountability.

6. Tax Return & Compliance Updates

Odoo 19 introduces an upgraded Tax Return feature that helps businesses stay compliant across multiple regions.

- Supports country-specific tax templates (VAT, GST, or sales tax)

- Tracks fiscal deadlines

- Auto-validates entries before filing

For businesses operating in tax-sensitive regions like the Gulf or the EU, this means fewer surprises and fewer sleepless nights during audit season.

7. AI-Powered Duplicate Bill Detection

We all know how easy it is to upload the same vendor bill twice.

Odoo 19 now instantly flags potential duplicates, keeping your records clean and preventing overpayment or double-counting.

Even after posting, duplicate bills remain highlighted, helping your team stay alert.

8. Instant Report Annotations & Notes

Need to explain a journal entry or add clarification for an auditor?

You can now add annotations directly to financial reports, visible in the system chatter.

This allows for smooth collaboration between accountants, managers, and auditors no external emails or manual notes required.

Real-Time Insights = Real Confidence

One of the most powerful features of Odoo Accounting is real-time visibility.

From your dashboard, you can track:

- Invoices issued and payments received

- Outstanding balances

- Reconciliation status

- Budget vs. actual performance

This means you can prepare audit-ready reports anytime, not just at year-end.

“Audit readiness isn’t about last-minute rush; it’s about everyday accuracy.”

Why Businesses Love Odoo Accounting in 2026

- Built-in transparency keeps everyone accountable.

- Localization-ready for regional tax laws and compliance.

- AI-driven automation reduces errors.

- Multi-currency, multi-entity support simplifies global operations.

- User-friendly dashboards give teams financial clarity not complexity.

From SMEs to large enterprises, businesses worldwide are using Odoo 19 as their financial control center — and auditors love it just as much.

Setting Up Audit-Proof Accounting with Zolute

Migrating to Odoo Accounting might sound technical, but with the right partner, it’s quick and stress-free.

At Zolute Consulting, we help businesses configure Odoo for complete audit transparency from data migration and localization to automated reporting and training.

We tailor your system to match your business needs so that by the time your next audit arrives, you’re not scrambling, you’re ready.

“With Zolute, Odoo doesn’t just record your numbers, it protects your peace of mind.”

Conclusion: From Panic to Peace of Mind

Audit season doesn’t have to bring anxiety anymore.

With Odoo 19, businesses can achieve full financial visibility, automatic compliance, and error-free reporting all in one connected platform.

So the next time someone says, “The auditors are coming,” you’ll smile because you’ll already be ready.

“Odoo keeps your finances clean, transparent, and audit-proof all year long.”

Post Comment