Table of Contents

Finance teams today are under more pressure than ever.

Customers expect faster billing, managers expect real-time reports, and regulators demand accurate records. Meanwhile, many businesses still run accounting on spreadsheets, outdated software, or disconnected tools.

This leads to the same real-life problems every month:

- Missing invoices

- Slow reconciliations

- Late financial reports

- Errors that nobody notices until year-end

- Stress during audits

- Endless manual work

The truth is simple:

Traditional accounting systems cannot handle the speed, complexity, and real-time demands of modern business.

That’s why 2026 is becoming the year companies shift to ERP-based accounting tools like Odoo, Zoho, Oracle NetSuite, SAP Business One, and Microsoft Dynamics — systems built for accuracy, automation, and complete visibility.

Let’s explore how modern ERPs fix today’s finance problems and future-proof your entire team.

The Real-Life Pain Finance Teams Face Daily

Before we talk solutions, we have to acknowledge the pain points. Finance teams across the UAE, USA, Africa, the Gulf, and Western markets repeatedly face the same issues:

No real-time visibility

By the time reports are prepared, the numbers are already outdated.

Managers make decisions based on old data — which slows growth and increases risk.

Manual entry overload

Entering the same data into multiple systems wastes hours.

It’s tiring, repetitive, and creates mistakes that are expensive to fix.

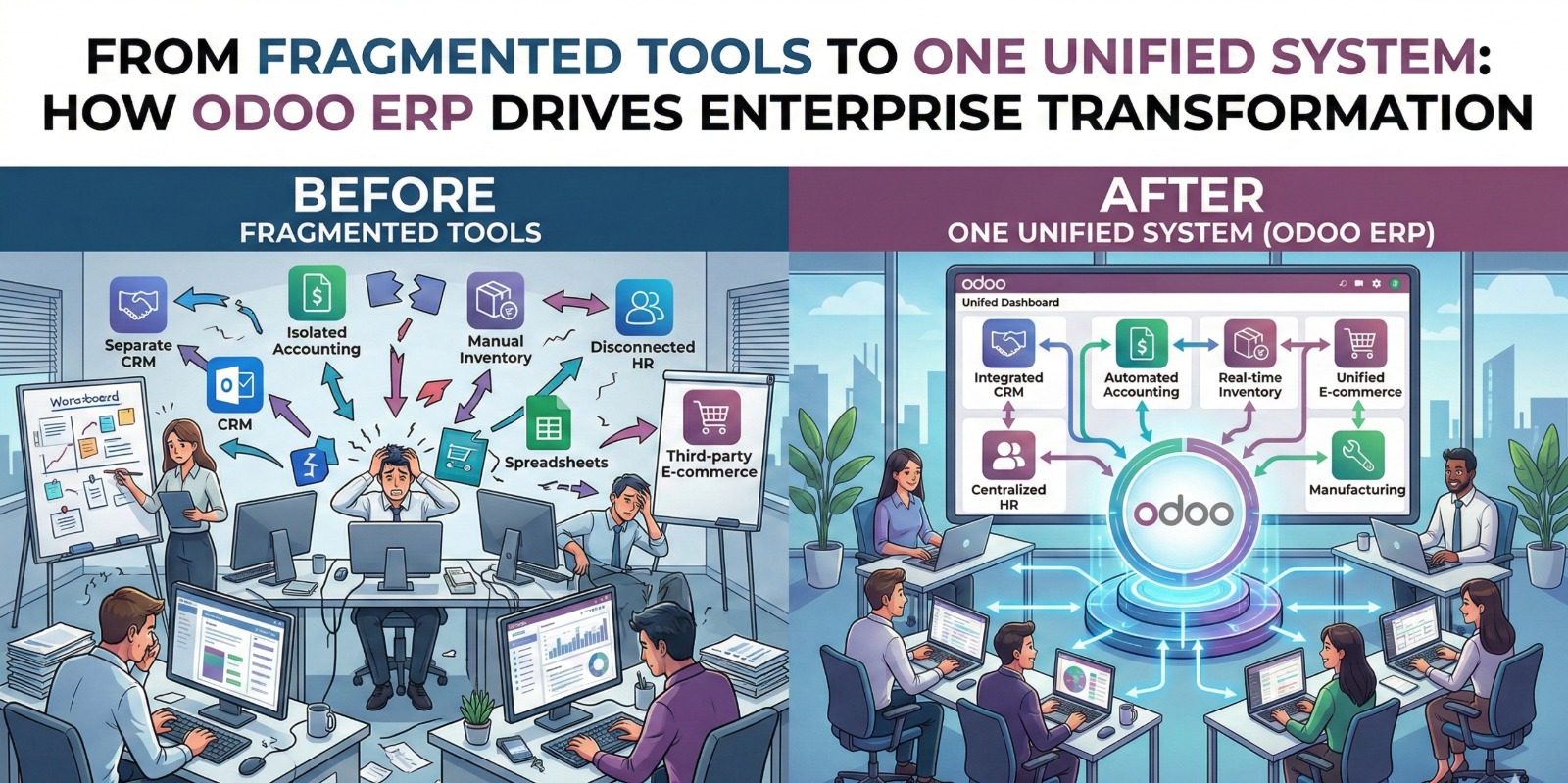

Scattered systems

Sales uses one tool, HR another, operations another, and finance something else.

Nothing talks to each other.

This creates gaps, duplicates, and confusion.

Slow month-end closing

The month-end process takes days of checking, verifying, correcting, and reconciling.

All because data is not clean or integrated.

Audit stress

Missing receipts, duplicate bills, incorrect entries…

Audits become a struggle instead of a smooth process.

Finance teams don’t lack skill — they lack the right tools.

The 2026 Solution: Modern ERP-Based Accounting

Modern ERPs are not just “accounting software.”

They are all-in-one, intelligent platforms that bring:

- Accounting

- Invoicing

- Banking

- Inventory

- HR

- CRM

- Projects

- Tax

- Reports

…all under one connected system.

This means the finance team finally gets the one thing they always needed:

Clean, real-time, automated financial data.

Let’s break down how ERP accounting tools solve real business problems.

1. Real-Time Dashboards (Instant Visibility)

Modern ERPs give you dashboards that update every second:

- Current cash flow

- Bank balances

- Pending invoices

- Expenses

- Budget vs. actual

- Inventory valuation

- Profit & loss trends

No more waiting for emails or Excel sheets.

Managers get answers instantly.

This helps companies avoid cash shortages, delivery delays, and bad decisions.

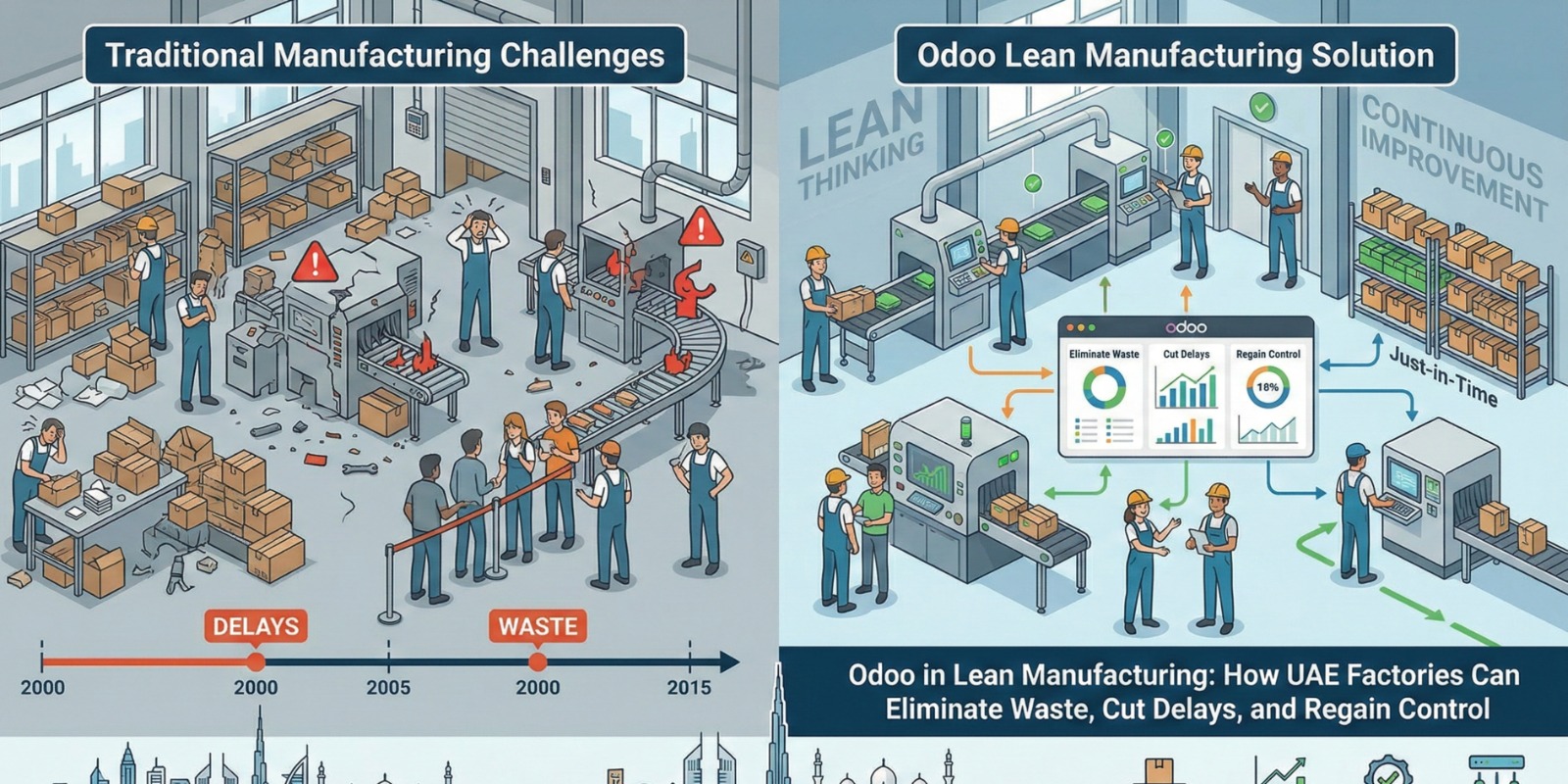

2. Full Automation (No More Manual Work)

ERP systems automatically handle tasks like:

- Invoice creation

- Payment reminders

- Expense categorization

- Bank reconciliation

- Tax calculation

- Exchange rate updates

- Inventory costing

- Asset depreciation

This reduces manual work by 40–70%, giving teams more time for analysis instead of data entry.

3. Seamless Integration (Everything Connected)

When all systems connect:

- A sale automatically becomes an invoice

- Stock updates without manual entry

- Payroll flows into accounting

- Vendor bills link to purchase orders

- Projects connect to expenses

- CRM connects to revenue reports

This level of integration removes errors and saves hours of work.

4. AI-Powered Accuracy (The Smartest Upgrade)

2026 ERPs come with AI features such as:

- Duplicate bill detection

- Smart account suggestions

- Fraud/anomaly detection

- Predictive budgeting

- Smart matching during reconciliation

- Automated document scanning (OCR)

These features help companies avoid mistakes before they happen.

5. Audit-Ready Records (Zero Panic)

With ERPs, everything is tracked automatically:

- Who created what

- When it was changed

- What documents are attached

- Which entries were approved

Every number has a clear trail.

Auditors love this because it saves time and provides full clarity.

6. Multi-Currency, Multi-Branch, Multi-Country Support

Perfect for global markets:

- Automatic currency conversion

- Separate branch accounting with consolidation

- Country-specific tax rules (VAT, GST, sales tax)

- Multiple languages for international teams

This makes scaling easier and safer.

7. Mobile Finance Management

Approvals, invoices, reports — all accessible on mobile.

Owners, CFOs, and managers can:

- Approve payments

- Check cash flow

- Track expenses

- View reports

…from anywhere in the world.

What Modern ERPs Like Odoo & Zoho Offer (New Features 2026)

Here are some high-demand updates businesses love:

Odoo 19

- New audit trail

- Improved OCR for bills

- Smart reconciliation

- AI-based error detection

- Composite annual report

- Updated VAT tools

- Faster interface

Zoho Books 2026

- Automated workflows

- Built-in approval chains

- Real-time analytics

- Smart audit logs

- Multi-currency upgrades

- Business dashboard widgets

These features make your finance team faster, smarter, and more confident.

The Future of Finance Is Real-Time, Automated & Connected

If your finance team still uses spreadsheets or outdated accounting tools, it’s time for a change.

2026 belongs to businesses that operate smart, fast, and integrated.

ERP-based accounting tools give your finance team:

✨ More control

✨ More visibility

✨ More automation

✨ Fewer errors

✨ Stress-free audits

✨ Faster decisions

And most importantly —

They future-proof your entire business.

Post Comment