Table of Contents

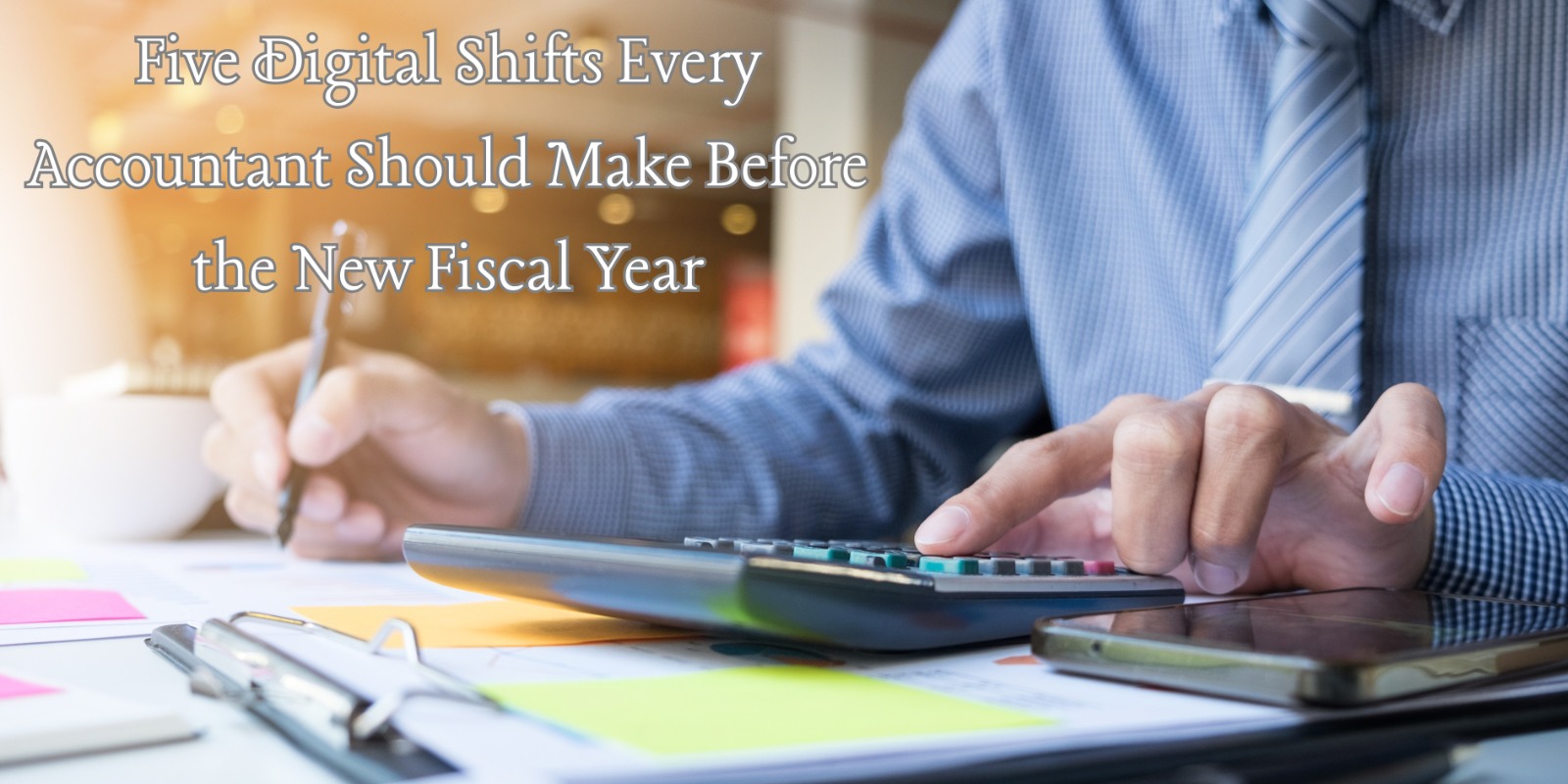

Accounting is changing faster than ever. New tools, new laws, and new digital habits are shaping how accountants work every day. As the new fiscal year approaches, this is the perfect time to upgrade the way you manage books, clients, reports, and workflows. These changes are not just “good to have”—they help you work smarter, save time, stay compliant, and keep your clients happy.

In this blog, we will talk about five important digital shifts every accountant should make. These ideas are simple, practical, and easy to start today. Whether you work in a firm or run a small accounting practice, these upgrades will help you step into the new year with more confidence and less stress.

1. Move to Cloud-Based Accounting Tools

Cloud accounting is no longer the future—it is the present.

If you are still using old software installed on one computer, you are slowing down your work without even knowing it.

Why this shift matters

Cloud-based accounting tools let you:

- Access accounts from anywhere (office, home, travel).

- Share files with clients instantly.

- Avoid data loss from laptop crashes.

- Get automatic updates, backups, and security.

What’s new in 2026?

Modern cloud tools now offer:

- Real-time dashboards

- Auto-generated financial summaries

- Invoice reminders

- Multi-device access

- Bank rule automation

If you start the fiscal year with cloud tools, you’ll finish it with more time saved and fewer mistakes made.

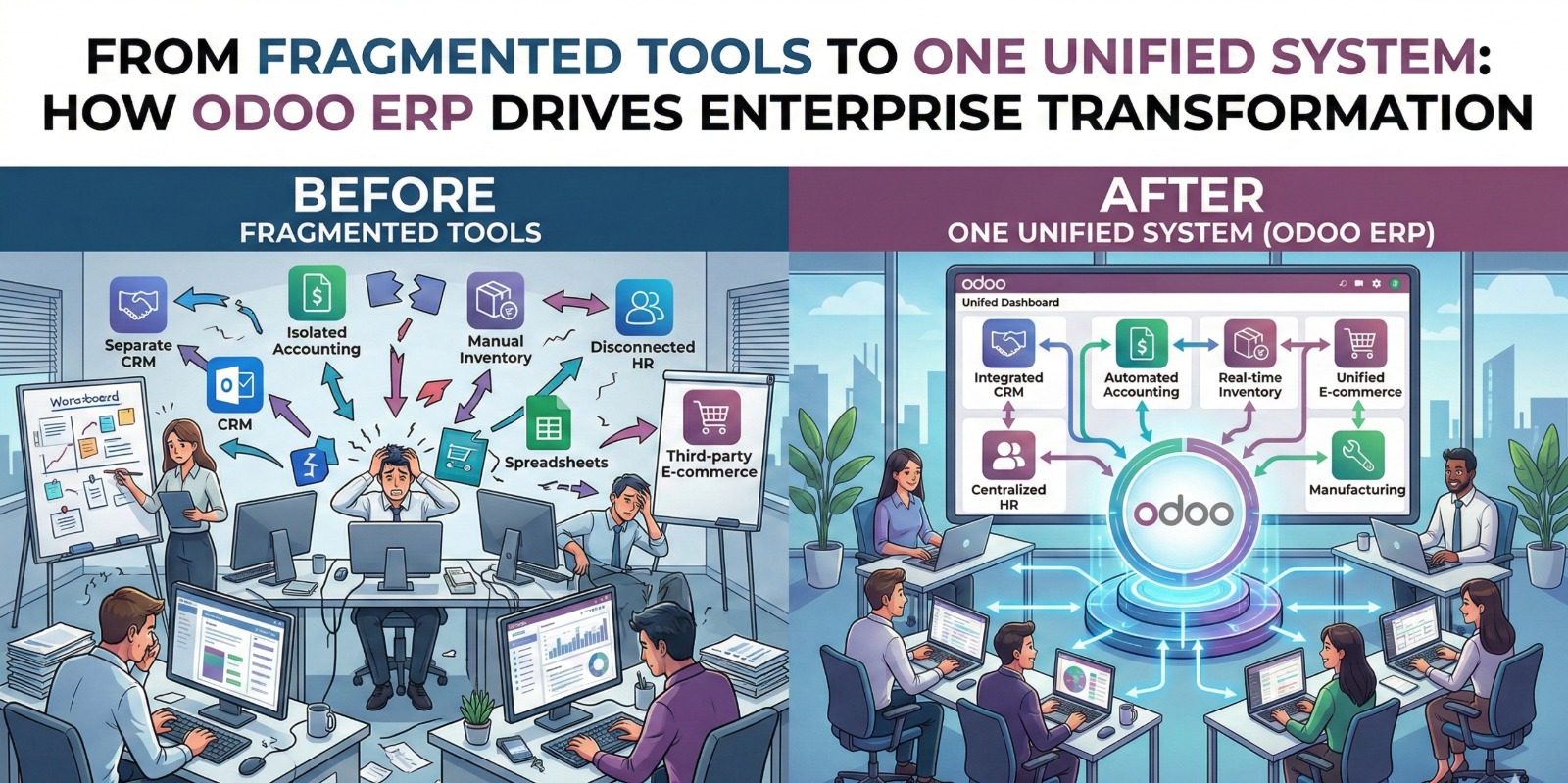

2. Adopt AI-Based Bookkeeping and Automation

AI is transforming accounting. Earlier, accountants spent hours on tasks like data entry, reconciliations, sorting receipts, and checking mistakes. Now, AI can do most of these in minutes.

Why this shift matters

AI tools help you:

- Detect errors quickly

- Match invoices and payments automatically

- Read receipts and upload them

- Predict cash flow

- Reduce manual work

What’s new in 2026?

AI platforms are now offering:

- Receipt scanning with 99% accuracy

- Smart reconciliation suggestions

- Tax classification automation

- Voice-to-entry accounting

- AI-generated monthly financial summaries

This means accountants can focus more on advisory work and less on typing numbers all day.

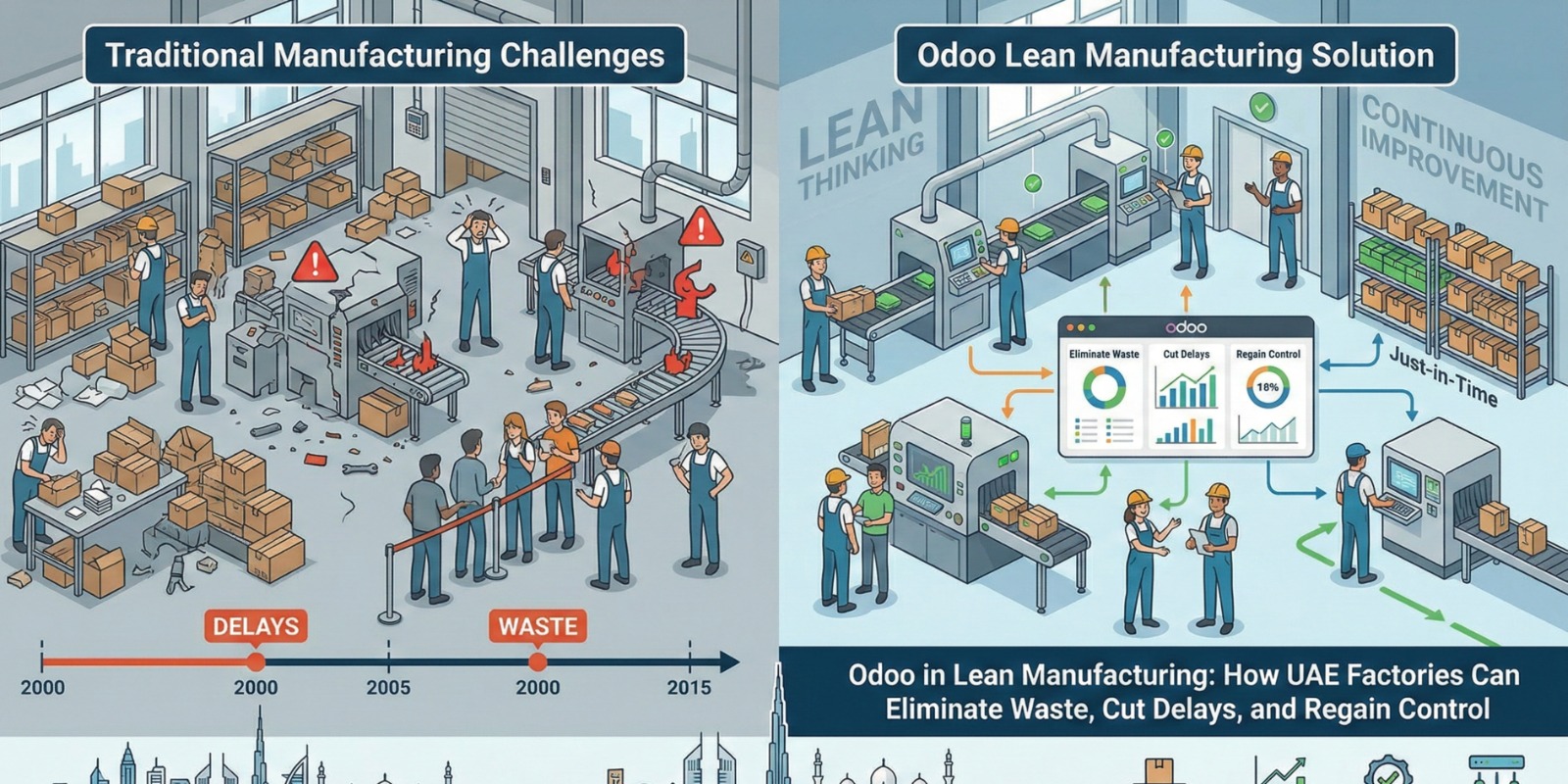

3. Use Secure Digital Document Management

Gone are the days of paper files, printed statements, and long email threads.

Today, accountants must use safe digital document systems—especially with rising data breaches and compliance requirements.

Why this shift matters

A proper digital document tool lets you:

- Store all client files in one secure place

- Share documents safely

- Track who viewed what

- Sign documents online

- Search old files instantly

What’s new in 2026?

Digital document platforms now include:

- E-signatures

- Secure client portals

- Version control

- Encrypted file sharing

- Auto-backups

This shift protects your work and builds client trust—something every accountant needs.

4. Upgrade to Digital Payments and Smart Billing

Manual invoicing and waiting for bank transfers can slow down your cash flow. Today’s clients want faster, easier, and digital ways to pay.

Why this shift matters

Digital billing tools help you:

- Send invoices in seconds

- Collect payments online

- Track overdue payments

- Set automatic reminders

- See payment history instantly

What’s new in 2026?

Smart billing platforms now support:

- Auto-generated invoices from completed tasks

- Instant payment links

- Auto-payment scheduling

- QR code payments

- Integration with your accounting system

When your billing goes digital, your revenue becomes quicker and smoother.

5. Build a Client Communication Hub

Accountants handle many clients, documents, deadlines, and queries. Without a proper communication system, you lose time answering repeated questions or digging through emails.

A digital client communication hub is essential.

Why this shift matters

A hub helps you:

- Share updates in one place

- Reduce back-and-forth emails

- Track client requests

- Stay organized

- Improve client experience

What’s new in 2026?

Client hubs now include:

- Chat portals

- Ticket-style query management

- Shared task lists

- Notification systems

- AI chat assistants for FAQs

With one digital space for communication, you work faster and clients stay informed without stress.

Conclusion

The accounting world is changing, and every accountant must adapt. These five digital shifts—cloud tools, AI automation, digital documents, smart billing, and better communication systems—will make your work easier, faster, and more secure. You don’t need to switch everything overnight. Start with one shift today, and you’ll be ready to enter the new fiscal year with stronger systems and better results.

Digital changes are not about replacing accountants. They are about helping accountants do their best work with less effort.

Make these shifts now, and the next year will be smoother, smarter, and more successful for you and your clients.

Post Comment