Built-in audit trails and compliance for UAE and African business standards

Table of Contents

Audits Don’t Have to Be Stressful

For many businesses in the UAE and across Africa, audits are a source of anxiety. Missing documents, unclear entries, manual spreadsheets, and last-minute data collection can turn audits into a nightmare. Regulators and tax authorities now expect clean, transparent, and well-documented financial records at all times.

This is where Odoo makes a real difference.

With Odoo 19, businesses can stay audit-ready 24/7. Every transaction is recorded, time-stamped, and traceable. Nothing is hidden, nothing is lost, and nothing needs to be recreated at the last moment. Simply put: proof is always at your fingertips.

Why Audit Trails Matter More Than Ever

Audit requirements are becoming stricter, especially in regions like the UAE, GCC, and Africa.

Most authorities now expect:

- Clear transaction history

- User-level accountability

- Accurate VAT and tax records

- Tamper-proof financial data

- Easy access to reports

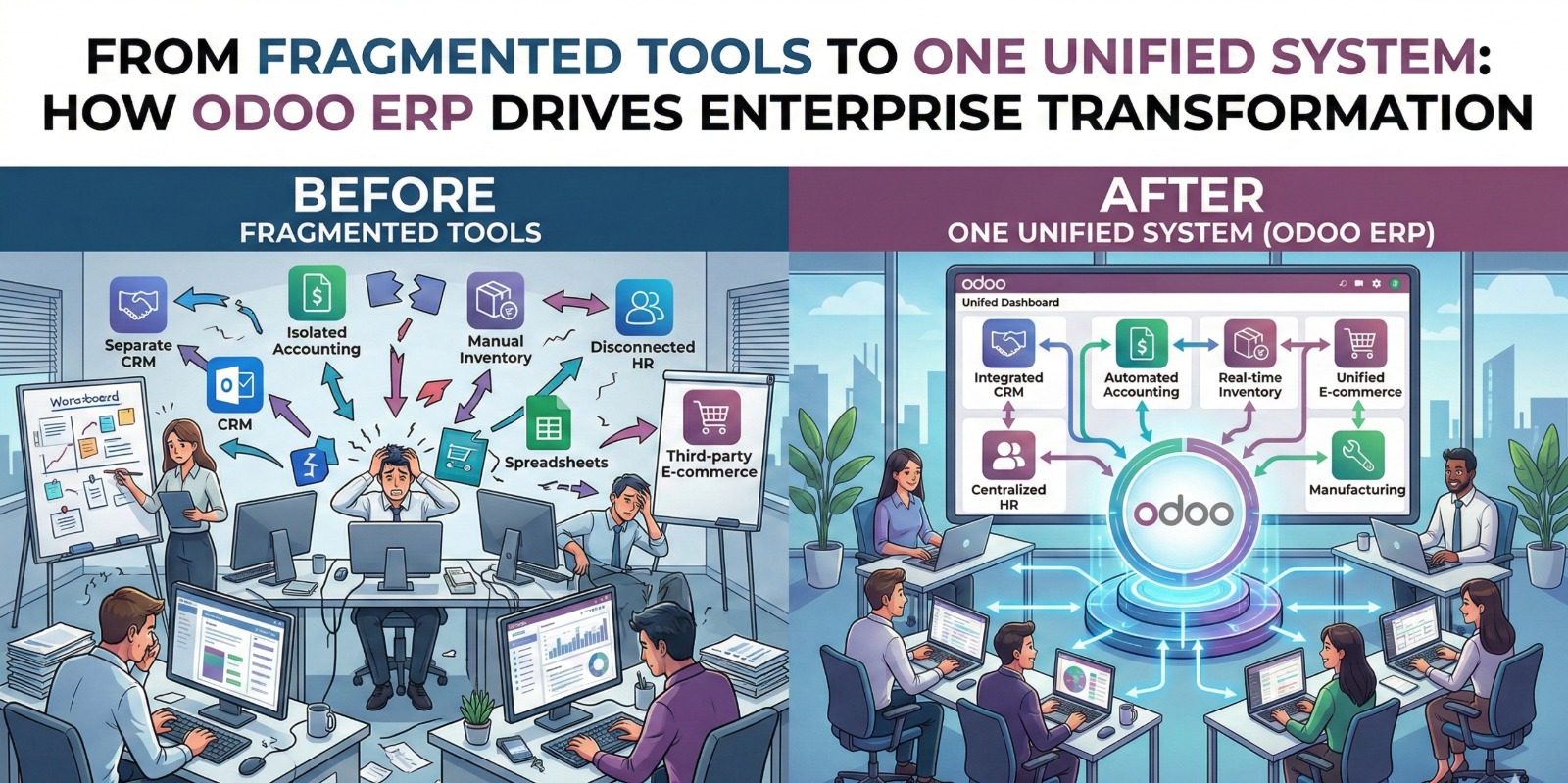

Manual systems and disconnected tools cannot keep up with these demands. A modern ERP with a built-in audit trail is no longer optional. It is essential.

What Is an Audit Trail in Odoo?

An audit trail is a complete record of every financial action in your system.

In Odoo, this means:

- Who created or edited a transaction

- What was changed

- When the change happened

- The original and updated values

Every invoice, bill, payment, journal entry, and adjustment leaves a digital footprint. This creates full transparency and builds trust with auditors and regulators.

Key Audit-Ready Features in Odoo 19

1. Automated Transaction Logs

Odoo 19 automatically records all accounting actions. Users do not need to enable anything manually.

This includes:

- Sales invoices

- Vendor bills

- Payments and refunds

- Journal entries

- Credit and debit notes

Once saved, entries are logged and traceable. Changes are recorded, not erased.

2. Strong User Access and Role Control

Odoo allows businesses to define clear user roles.

For example:

- Accountants can post entries

- Managers can approve changes

- Auditors can view data only

This ensures:

- No unauthorized edits

- Clear responsibility for every action

- Reduced risk of internal fraud

Auditors can easily see who did what and when.

3. Edit History and Change Tracking

Mistakes happen. Odoo understands that.

Instead of hiding changes, Odoo:

- Keeps the original record

- Logs the updated version

- Stores both for review

Auditors can clearly see corrections without confusion or suspicion. Transparency builds confidence.

4. VAT and Tax Compliance for UAE & Africa

Odoo 19 supports region-specific compliance needs, including:

- VAT-ready invoicing

- Tax grouping and tax reports

- Audit-friendly tax breakdowns

For UAE businesses, VAT records are structured and exportable.

For African businesses, local tax rules and multi-currency handling are supported.

Reports can be generated in seconds instead of days.

5. Real-Time Financial Reports

With Odoo, audit preparation does not require manual compilation.

You can instantly access:

- General ledger

- Trial balance

- Profit and loss statements

- Balance sheets

- Tax summaries

All reports are based on live data, reducing errors and manual effort.

6. Secure Document Management

Odoo links financial records with documents such as:

- Invoices

- Bills

- Receipts

- Contracts

Documents are stored securely and attached to transactions. During audits, everything is in one place—no searching through emails or folders.

How Odoo Reduces Audit Stress

Traditional audits often fail because:

- Data is scattered

- Entries are unclear

- Documentation is missing

Odoo solves this by centralizing everything.

With Odoo:

- Audits become routine, not disruptive

- Teams stay confident and prepared

- Compliance becomes a daily habit

Instead of panic, audits become a simple verification process.

Real-World Impact for Businesses

Companies using Odoo report:

- Faster audit completion

- Fewer audit queries

- Lower compliance costs

- Improved internal controls

For growing businesses in the UAE and Africa, this means smoother operations and stronger credibility with regulators, investors, and partners.

What’s New in Odoo 19 for Audit & Compliance

Odoo 19 brings important improvements:

- Better activity logs

- Faster report generation

- Improved document linking

- Stronger access control rules

- Enhanced accounting dashboards

These updates make compliance even simpler and more reliable.

Conclusion: Proof at Your Fingertips

Audits do not have to interrupt your business or create stress.

With Odoo 19:

- Every transaction is traceable

- Every change is recorded

- Every report is ready

You stay compliant without extra effort.

Proof at your fingertips. That’s Odoo Accounting.

If your business operates in the UAE or Africa and wants audit-proof accounting with peace of mind, Odoo is built to support you—today and in the future.

What is an audit trail in ERP accounting?

An audit trail is a complete record of every financial action in an ERP system. It shows who created or changed a transaction, what was modified, and when it happened. This helps businesses prove accuracy during audits.

How does Odoo keep transactions traceable?

Odoo automatically records all accounting activities such as invoices, bills, payments, and journal entries. Each action is time-stamped and linked to a user, making every transaction fully traceable.

Is Odoo 19 audit-proof for growing businesses?

Yes. Odoo 19 is designed to support audit readiness with built-in logs, controlled access, and transparent records. It helps businesses stay prepared for audits at any time without last-minute effort.

Can Odoo track edits and corrections in accounting entries?

Yes. When an accounting entry is edited, Odoo keeps a record of the change. Auditors can see both the original and updated information, which improves transparency and trust.

Is Odoo compliant with UAE VAT requirements?

Odoo supports VAT-ready invoicing, tax calculations, and detailed tax reports. This helps UAE businesses maintain organized VAT records that are easier to review during audits.

Post Comment