Table of Contents

Accounting Is Changing Faster Than Ever

A new fiscal year is not just about closing old books and opening new ones. It is also the perfect time to rethink how accounting work is done. Clients now expect faster answers, real-time numbers, and clear advice—not just reports at the end of the month.

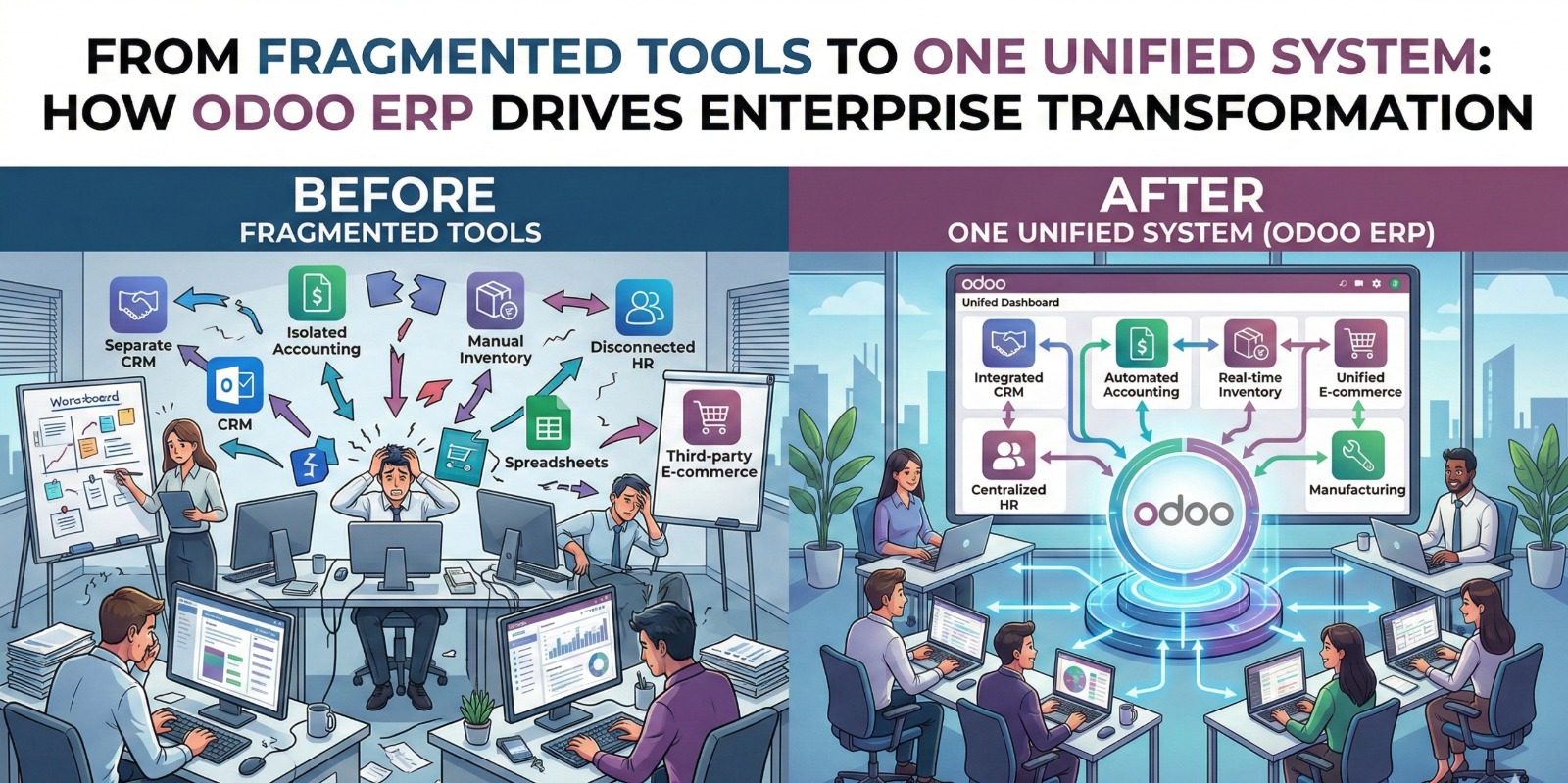

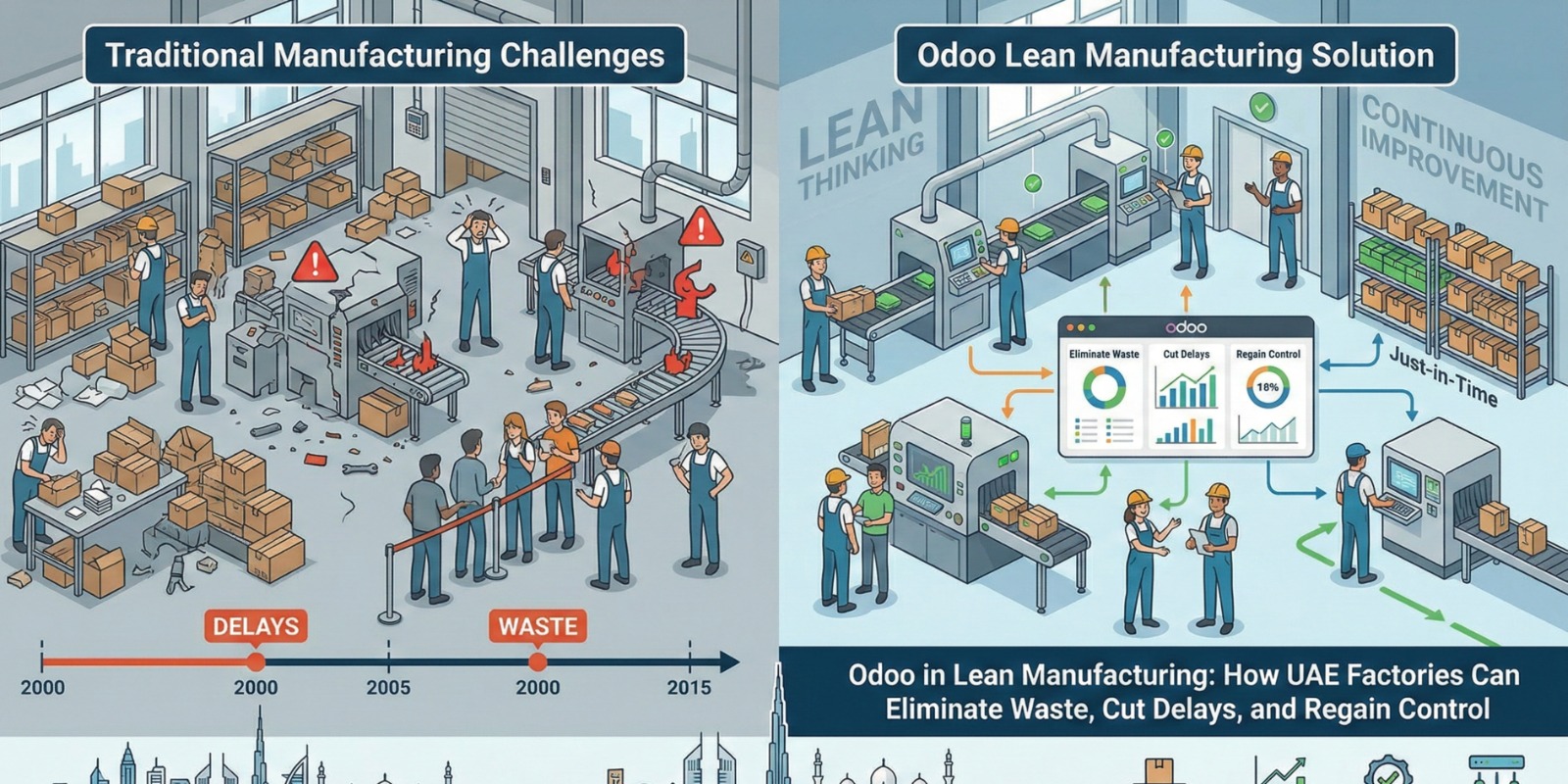

Many accountants still rely on manual processes, scattered spreadsheets, and outdated tools. These methods may have worked before, but today they slow you down and increase the risk of errors. Digital tools are no longer optional. They are essential for accuracy, speed, and growth.

In this article, we will explain five simple but powerful digital shifts every accountant should make before the new fiscal year. The language is simple, the ideas are practical, and each shift focuses on real improvements you can see and feel in daily work.

Move from Manual Work to Smart Automation

Manual data entry is one of the biggest time-wasters in accounting. Entering invoices, matching bank transactions, and preparing reports by hand takes hours and leads to mistakes.

The first digital shift is automation. Modern accounting tools can now:

- Automatically import bank statements

- Match invoices with payments

- Calculate taxes and totals

- Generate standard reports in seconds

New automation features also include rule-based categorization. For example, once you tag a transaction, the system remembers it and applies the same logic next time. This reduces repetitive work and keeps data clean.

By automating routine tasks, accountants can focus more on analysis, planning, and client guidance instead of typing numbers all day.

Shift from Desktop Software to Cloud-Based Accounting

Traditional desktop accounting software limits where and how you work. Files are stored on one system, updates are manual, and collaboration is difficult.

Cloud-based accounting changes this completely. With cloud systems, you can:

- Access data anytime, from anywhere

- Work with clients in real time

- Get automatic updates and backups

- Share reports instantly

New cloud features now include live dashboards, instant syncing across devices, and stronger data security. Many platforms also offer mobile apps, so you can approve expenses or review reports on the go.

This shift improves flexibility and ensures that everyone—accountants, clients, and auditors—is always looking at the same numbers.

Move from Year-End Reports to Real-Time Insights

Many accountants still prepare reports only at month-end or year-end. By the time clients see the numbers, it is often too late to act.

The third digital shift is moving to real-time financial insights. Modern systems now provide:

- Live profit and loss views

- Cash flow tracking is updated daily

- Expense trends and alerts

- Budget vs actual comparisons

New features also include visual charts and simple dashboards that even non-finance clients can understand. This makes conversations easier and more meaningful.

When clients can see their financial health in real time, they make better decisions. Accountants also become trusted advisors instead of just compliance partners.

Shift from Isolated Tools to Integrated Systems

Using separate tools for accounting, payroll, invoicing, inventory, and expenses creates confusion. Data does not match, work is repeated, and errors increase.

The fourth digital shift is system integration. Today’s accounting platforms can connect with:

- Payroll systems

- Expense management apps

- Inventory and sales tools

- Tax and compliance software

New integration features allow automatic data flow between systems. For example, a sales invoice can update revenue, taxes, and inventory at the same time—without manual effort.

Integrated systems create one source of truth. This saves time, improves accuracy, and gives a full view of the business in one place.

Move from Basic Compliance to Advisory Services

Accounting is no longer just about filing returns and meeting deadlines. Clients want advice, planning, and future-ready guidance.

The final digital shift is changing the role of the accountant. With automation and real-time data in place, accountants can now offer:

- Cash flow planning

- Tax-saving strategies

- Cost control insights

- Business growth advice

New tools include forecasting models, scenario planning, and AI-based suggestions that highlight risks and opportunities. These features help accountants explain “what may happen next,” not just “what already happened.”

This shift increases value, builds stronger client relationships, and opens new revenue opportunities for accounting firms.

Conclusion: Start the New Fiscal Year the Smart Way

The new fiscal year is a fresh start. Making these five digital shifts can completely change how accounting work feels and functions. You save time, reduce stress, improve accuracy, and deliver more value to clients.

To recap, the five key shifts are:

- Automate manual tasks

- Move to cloud-based accounting

- Use real-time financial insights

- Integrate all finance tools

- Evolve from compliance to advisory

You do not need to change everything overnight. Start with one shift, implement it well, and move step by step. The accountants who adapt early will lead the future—while others struggle to catch up.

The question is not whether digital accounting is coming. It is whether you are ready for it before the new fiscal year begins.

Post Comment